Classic Car Investment Using Business Analysis Tools

The Historic Automobile Group International (HAGI), founded in 2007, has chosen new avenues to analyse the collectors’ market for rare classic cars. Following the motto “driven by knowledge” the approach is based on financial analysis, adjusted to the specialties of this niche collectors’ asset class. HAGI is known in the market to produce a series of indices charting the top levels of the classic car market.

One major new aspect about this approach is that HAGI is an independent research house and think tank with specialist expertise in the rare classic motorcar sector and in finance. The group has created its benchmarks to track this alternative asset class accurately for the first time, using rigorous financial methodology usually associated with more traditional investments. Updated monthly on HistoricAutoGroup.com the HAGI Top Index is published monthly by the Financial Times (FT.com/reports/wealth) in Octane magazine UK, Classic Sportscar France, Handelsblatt online and Motorklassik in Germany to name a few.

The HAGI Index Group has developed their indices based on thousands of documented transactions collected from four areas: broker/dealers, marque specialists, auction results and private individuals. The indices have also been back-tested annually to 1980. The findings are compelling. They support the investment case and make this asset class fully comparable for the first time. From the end of 2008 the HAGI Indices are updated on a monthly basis. Four indices have been published so far: The HAGI Top 50 comprising of rare models from all marques and age periods, the 1920s to the supercars of 2000. The HAGI F and HAGI P indices, which measure the market for rare Ferrari and Porsche respectively. Also published it the HAGI ex P& F Index, which contains 24 car models other than Porsche and Ferrari.

Picking the Winners

The research discloses that a number of vehicle categories have been attractive for investment. Production numbers, technical attributes and ownership history, together with current condition and attractiveness, are the main parameters. The most relevant time periods are pre-war and 1950s through to the early 1990s, with an emphasis on

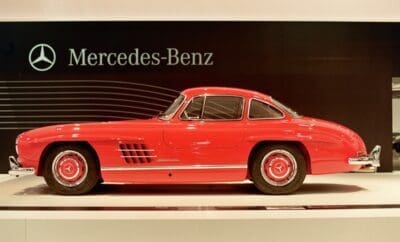

the earlier decades. Well-known car marques like Aston Martin, Bentley, Ferrari and Porsche create most of the headlines in the historic-car world. As well, rare racing and road versions of automobiles made by – for example – Mercedes-Benz and Maserati and more unusual marques like Voisin , Bizzarrini or Graham are highly valued by collectors. Attractive models that were produced in small numbers have the highest public profile and the strongest credentials for the most exclusive events. Rare, high quality cars are most attractive for the collector. HAGI believes they have the potential to provide stable returns going forward.

Performance examples:

The HAGI Top Index, measuring the performance of 50 key collectible classic cars, advanced by 13.89% in 2011. However, another HAGI index calculation reveals a segment of the top market that has achieved amazing 21.65% growth in 2011. That’s the return offered by the HAGI Top with Ferrari and Porsche removed, se above. (In 2011 the HAGI F Ferrari Index advanced 10.58%, while the HAGI P Porsche Index returned more modest 4.53%, after strong growth in previous years.)

For 2012 year to date the figures look even stronger with the benchmark Index, the HAGI Top 50 advancing 21.5% through August and the sector for collector’s Ferrari (as measured by the HAGI F Index) gaining a 26.4%.

Dietrich Hatlapa, HAGI’s founder and former investment banker, commented: “The figures demonstrate very clearly that this is not a uniform market; performance varies from marque to marque and from model to model. Choice and timing are key, and that’s what makes it so fascinating, applying a judgement call based on a model or marque that’s due for rotation.”

Hatlapa also highlighted six models that have performed well in this market in 2011:

– The Ferrari 250GTL ‘Lusso‘ you could buy for £450,000 at the end of 2010 whereas at the beginning of 2012 you would have to pay 70,000 more for the same car.

– Bentley R-type Continental Fastback by H.J.Mulliner, 1952-55 (208 produced): A nice example trading at £400,000 at the start of 2011 could now make £600,000-plus.

– BMW 507, 1956-59: was £500,000, now £850,000 or more for best cars.

– Jaguar XJ220: was £140,000; now £180,000-plus

– Aston Martin DB5 saloon £275,000 – 400,000

– Mercedes-Benz 300SL roadster £600 – 700,000

In 2011 Dietrich and the HAGI team published ‘Better Than Gold, Investing in Historic Cars’, a comprehensive book that lists many of the group’s finding, e.g. the sectors’ performance since 1980 as well as introducing the indices background, their methodologies, marques and models in detail. An extensive glossary lists price relevant data as well as current index constituents, all in all demonstrating many new aspects of this sector to the expert as well as making it transparent for the novice entrant.

By Historic Automobile Group International (HAGI), 9/12