The Global Luxury Residential Real Estate Report 2015

Nearly US$3 trillion of the world’s private wealth is held in owner-occupied residential properties, a value greater than the GDP of India, a new report by Wealth-X and the Sotheby’s International Realty® brand released today showed.

There are 211,275 ultra high net worth (UHNW) individuals – defined as those with US$30 million and above in net assets – in the world and 79% of them own two or more residences.

Some of the main hubs for luxury residential real estate are New York City, London and Hong Kong, but niche locations – such as Lugano, the Hamptons outside New York City, and rural areas around the world – are gaining in popularity.

The Wealth-X and Sotheby’s International Realty Global Luxury Residential Real Estate Report forecasts that the ongoing shift in the wealth creation cycle from the West to the East, and the growing significance of intergenerational wealth transfers will have significant consequences on the luxury residential real estate market – with a noted emphasis on new developments and a change in investment grade cities.

Below are other key findings from the inaugural report:

The value of UHNW-owned residential real estate assets increased by 8% globally in 2014.

On average, UHNW individuals own 2.7 owner-occupied residences.

As of 2014, over 7% of the world’s UHNW population made their wealth through real estate, up from 5% in 2013.

Ultra affluent women value real estate assets more than their male counterparts, holding 16% of the net worth in such assets, on average, compared to less than 10% for men.

Luxury residential real estate is an asset class typically favoured by UHNW individuals with inherited wealth: these individuals hold 17% of their net worth in such assets, compared to just under 9% for self-made UHNW individuals.

UHNW individuals with net worth between US$30 million and US$50 million typically keep their primary residences for over 15 years and their secondary residences for over 10 years.

Billionaires change one of their four properties, on average, once every three years.

Secondary residences are typically 45% more valuable than primary residences; twice the square footage and have 10 acres of land.

At 83%, Monaco has the highest density of foreign-owned UHNW residences.

Over 6% of the world’s UHNW population have relocated their primary residence to a different country from which they were born – these individuals often keep a secondary residence in their home countries, and India is the leading country in this respect.

The Wealth-X and Sotheby’s International Realty Global Luxury Residential Real Estate Report 2015, which looks at trends in the UHNW population’s appetite for luxury residential real estate across the world, identifies specific attitudes, behaviors and locations that matter to this industry and this wealth segment.

Global Ultra Wealthy Population Hold Nearly US$3 Trillion In Owner-Occupied Residential Real Estate Assets

The United States is the most popular country for foreign ultra wealthy individuals looking to buy secondary residences, followed by the United Kingdom and Switzerland

The Global Luxury Residential Real Estate Report 2015 identifies the most significant markets for UHNW residential property investment, provides a profile of the global luxury residential property consumers and offers insights into their spending habits relating to their luxury residential property investments.

Luxury residential real estate holds a special place within the portfolio of the world’s ultra wealthy. This report shows that UHNW individuals each own, on average, 2.7 properties. While they may purchase real estate for a variety of reasons – spanning from practical to passion to investment purposes – it represents one of the most intimate asset classes characterising their wealth. For the purpose of this report, we are using the label “investment” to describe UHNW luxury residential real estate ownership, whether that was their purpose or whether the primary purpose is for their personal and private leisure or living.

The value of UHNW-owned residences globally rose by 8% in the past year, according to the report’s UHNW Residential Real Estate Index. As capital continues to flow towards key cities and locations across the globe, and as available land becomes scarcer, such growth in value will continue.

The inaugural Global Luxury Residential Real Estate Report 2015 is the definitive source of data, insights and trends at the intersection between the world’s UHNW population and the global luxury residential real estate industry, illuminating the opportunities that these individuals present for this sector.

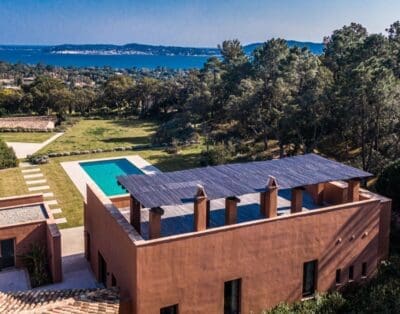

Mallorca Sotheby’s International Realty, $3.544 million, Mallorca, Spain.

• The world’s ultra high net worth (UHNW*) population totals 211,275, and these individuals each own, on average, 2.7 properties.

• US$2.9 trillion of the world’s UHNW wealth is held in owner-occupied residential real estate assets.

• 79% of the world’s UHNW individuals own two or more properties and just over half of them own three or more residences.

• UHNW individuals are increasing the number of properties they hold outside their home countries with the United States, United Kingdom and Switzerland being the three favourite locations.

• Over 7% of the world’s UHNW population have made their wealth through the real estate industry, up from 5% in 2013.

• The UHNW Residential Real Estate Index shows a 8% increase in the value of UHNW-owned residences globally in the past year.

• The United States is the most popular country for foreign UHNW individuals looking to buy secondary residences.

• New York is the city with the highest number of UHNW-owned residences in the world.

• Monaco has the highest density of foreign-owned UHNW residences – 83%.

• Female UHNW individuals value real estate assets more than their male counterparts, holding 16% of their net worth in such assets compared to less than 10% for men.

• UHNW Chinese and Russian multiple homeowners are typically self-made and young – these two clusters are becoming increasingly important buyers of luxury residential real estate around the world.

• Over 6% of the world’s UHNW population is made up of expatriates – those individuals who are currently based outside their home countries. These individuals are stimulating residential real estate demand in their home countries’ markets – for example, India’s non-resident population is increasing demand in Mumbai’s residential real estate market.

*Those with net worth of US$30 million or more.

Luxury residential real estate is property worth more than US$1,000,000 and typically owned by UHNW individuals.

79% of the world’s UHNW population owns two or more residences Secondary residences are 45% more valuable & twice as large Purchasing decisions are driven by:

7% of the world’s UHNW fortunes are made through real estate.

Real estate is an investment, an asset and a lifestyle. This report investigates the residential real estate market for ultra high net worth (UHNW ) individuals. These individuals typically not only own a residence in their primary business city, but also own secondary residences outside this home city and often outside their home country. The UHNW population forms the consumer base for the global luxury residential real estate market. There are varying definitions of “luxury residential real estate”

and some differ by location – for example, city penthouses and countryside mansions. In this report, we define “luxury residential real estate” as property owned by UHNW individuals, as long as this property is worth more than US$1,000,000. The purpose of this report is to investigate the relationship UHNW individuals have with these assets, focusing on certain cities and locations of particular relevance to this population.

PERSONAL REAL ESTATE: AN INVESTMENT AND A NEED

Numerous UHNW individuals have utilized real estate as an investment vehicle to increase their wealth, but these properties continue to have a primary purpose: first and foremost, they serve as residences.

Besides the obvious need to own a property in one’s primary business location, the time spent in other locations, whether for leisure or business purposes, may make the ownership of a secondary residence a practical and financially responsible course of action.

UHNW individuals’ personal and professional considerations, in that order, tend to drive the demand for residential real estate. Residential real estate, while it is known as a long-term safe investment, is almost always purchased because of a specific connection between a UHNW individual and a particular place. For example, many Asian UHNW individuals who buy property in the

top real estate markets for investment purposes are either choosing these markets because they are building up their business activities in the region or, increasingly, because their children are going to study abroad. Some of the main cities where UHNW individuals buy residential real estate outside of their home cities are located close to elite universities, financial hubs or often both.

Fast growth in emerging markets’ UHNW population and wealth, the global lifestyle of the world’s UHNW population and their flexible purchasing patterns mean that new residential real estate markets around the world will emerge

UHNW buyers have flexible purchasing patterns. They typically already own their primary property and most new purchases are for secondary residences. These individuals are global and, particularly if they buy for investment purposes, can choose any market to invest their wealth

in. We continue to see New York, London, Hong Kong and other such markets dominate the luxury residential property landscape, although other more niche markets such as Monaco, Lugano and even Marbella are also

attractive to UHNW investors. New markets are becoming increasingly important in generating investment from new UHNW individuals and therefore new demand for luxury residential real estate – whether for these new UHNW individuals, or for foreign-based UHNW individuals who want to enter these markets. Middle Eastern cities such as Abu Dhabi and Dubai continue to see soaring housing prices with high demand – spurred by the governments’ focus on tourism and real estate as sources of investment.

e.g. Standard of Living; Institutional Framework

All around the world – from St. Bart’s to Marbella, Mexico City to Mumbai – UHNW individuals own real estate, with clusters of various sizes forming in various locations. What this report also shows, however, is that some of the world’s most significant hubs for luxury residential real estate are tied to the identity of a particular city – from the appeal

of the Hamptons for New Yorkers in the finance industry to the attraction of Los Angeles for individuals involved in the entertainment industry.

One pervasive trend remains true – UHNW individuals’ interest in luxury residential real estate is not bound to any one location. Many in the UHNW population acquire properties in areas that have sentimental value and that can offer privacy. This is why, aside from their primary residences typically located in global hubs, UHNW individuals’ secondary residences in the countryside are often particularly luxurious.

The real estate industry is responsible for over 7% of the world’s UHNW fortunes, up from around 5% in the previous year.

LUXURY RESIDENTIAL REAL ESTATE: A FAST GROWING ASSET CLASS

Luxury residential real estate grew 2% faster than the general real estate market

The UHNW Residential Real Estate Index is comprehensive, incorporating data for New York, Hong Kong, London, Singapore, Dallas, Mumbai, Los Angeles, Paris, San Francisco and Washington DC, as well as Palm beach, Monaco and a composite index for countryside

properties around the world. The index, therefore, goes further than merely providing information on the UHNW real estate market in the main global financial hubs: it takes into account the luxury residential properties that are exclusively owned by the world’s wealthiest.

Although UHNW residential real estate experienced a small decrease in value in the last quarter of 2013, the appreciation of such assets has been strong in 2014. The performance of luxury residential real estate has been

better than that of non-luxury residential real estate. The Case-Shiller index – a proxy for residential real estate value – showed an appreciation of only 6% over the past year, 2% less than that of luxury residential real estate.

THE LUXURY RESIDENTIAL REAL ESTATE CONSUMER

On average, billionaires own four properties worth US$94 million.

UHNW individuals hold 25% of their wealth in cash.

Fast growth in luxury real estate demand expected.

US$2.9 trillion is held in owner-occupied residential real estate.

Typically UHNW individuals hold their primary properties 15 years and their secondary properties 10 years.

Individuals with inherited wealth hold 17.2% of their net worth in real estate – more than any other subgroup of the UHNW population, but Russian and Chinese buyers are defying this trend.

Women value real estate more than men.

Over 6% of the world’s UHNW population have relocated to a different country from which they were born

UHNW individuals are as likely to buy on credit as to pay cash when purchasing residential real estate properties

UHNW individuals typically own residential real estate in their primary business location. While all UHNW individuals have the financial resources to own luxury residential real estate, not all do, with some preferring

to own more residences, but of lower average value. The median net worth of the typical UHNW individual is US$78 million.

Predictably, the wealthier an individual, the higher the average value of his or her real estate holdings, yet luxury residential consumers can span across wealth tiers, with different individuals having different appetites for such assets. In part because of this phenomenon, different locations will have a unique appeal for individual buyers.

For example, billionaires are most likely to have residences in numerous countries outside their home country, while UHNW individuals in the lowest wealth tier will, unless they have moved away from their home country, generally have a more domestic appetite when it comes to residential real estate.

BILLIONAIRES & RESIDENTIAL REAL ESTATE: A FAST PACED RELATIONSHIP

4 Properties US$94 million.

2 Properties for vacation/holiday purposes Secondary residences are 33% more valuable.

Shorter time horizons Change one property every three years.

Top locations: London, New York, Paris, Monaco, Geneva.

The full report can be downloaded here: http://www.wealthx.com/wp-content/uploads/2015/02/Wealth-X-Sothebys-Glob…

Sotheby’s International Realt: http://www.sothebysrealty.com

Wealth X: http://www.wealthx.com